4111. Restricted Firm Obligations

(a) General

A member designated as a Restricted Firm shall be required, except as provided in paragraphs (e) and (f) of this Rule, to establish a Restricted Deposit Account and deposit in that account cash or qualified securities with an aggregate value that is not less than the member's Restricted Deposit Requirement, and shall be subject to such conditions or restrictions on the member's operations as determined by the Department to be necessary or appropriate for the protection of investors and in the public interest.

(b) Annual Calculation by FINRA of Preliminary Criteria for Identification

For each member, the Department will compute annually the Preliminary Identification Metrics to determine if the member meets the Preliminary Criteria for Identification.

(c) Initial Department Evaluation and One-Time Staff Reduction

(1) Initial Department Evaluation

If the member is deemed to meet the Preliminary Criteria for Identification, the Department shall conduct an internal evaluation to determine whether (A) the member does not warrant further review under this Rule because the Department has information to conclude that the computation of the member's Preliminary Identification Metrics included disclosure events (and other conditions) that should not have been included because they are not consistent with the purpose of the Preliminary Criteria for Identification and are not reflective of a firm posing a high degree of risk. The Department shall also consider whether the member has addressed the concerns signaled by the disclosure events or conditions or altered its business operations such that the Preliminary Criteria for Identification calculation no longer reflects the member's current risk profile, or (B) except as provided in paragraph (c)(2) of this Rule, the member should proceed to a Consultation.

(2) One-Time Staff Reduction

If the Department determines that the member meets the Preliminary Criteria for Identification and such member has met such criteria for the first time, such member may reduce its staffing levels to no longer meet the Preliminary Criteria for Identification within 30 business days after being informed by the Department. The member shall provide evidence of the staff reduction to the Department identifying the terminated individuals. Once the member has reduced staffing levels to no longer meet the Preliminary Criteria for Identification, it shall not rehire in any capacity a person terminated to accomplish the staff reduction for a period of one year.

(3) Close-Out Review

If the Department determines that the member no longer warrants further review in accordance with paragraph (c)(1)(A) or (c)(2) of this Rule, the Department shall close out the review of the member for such year.

(d) Consultation

(1) General

If the Department determines that the member meets the Preliminary Criteria for Identification and should proceed to a Consultation, the Department shall conduct the Consultation to allow the member to demonstrate why it does not meet the Preliminary Criteria for Identification and should not be designated as a Restricted Firm. If the member is designated as a Restricted Firm, the Department may require it to be subject to a Restricted Deposit Requirement or to such conditions or restrictions as the Department in its discretion shall deem necessary or appropriate for the protection of investors or in the public interest, or both. The member bears the burden of demonstrating that it should not be designated as a Restricted Firm and should not be subject to the maximum Restricted Deposit Requirement.

(A) A member may overcome the presumption that it should be designated as a Restricted Firm by clearly demonstrating that the Department's calculation that the member meets the Preliminary Criteria for Identification included events in the Disclosure Event and Expelled Firm Association Categories that should not have been included because for example, they are duplicative, involving the same customer and the same matter, or are not sales practice related; and

(B) A member may overcome the presumption that it should be subject to the maximum Restricted Deposit Requirement by clearly demonstrating to the Department that the member would face significant undue financial hardship if it were subject to the maximum Restricted Deposit Requirement and that a lesser deposit requirement would satisfy the objectives of this Rule and be consistent with the protection of investors and the public interest; or that conditions and restrictions on the operations and activities of the member and its associated persons would address the concerns indicated by the Preliminary Criteria for Identification and protect investors and the public interest.

(2) Scheduling Consultation

The Department shall provide a written letter to each member it determines should proceed to a Consultation or that will proceed to a Consultation pursuant to paragraph (f)(2) of this Rule at least seven days prior to the Consultation, of the date, time and place of the Consultation and shall coordinate with the member to schedule further meetings as necessary. A Consultation shall begin at the time scheduled, unless the Department, for good cause shown by the member, provides a written letter that postpones the commencement of the Consultation. Postponements shall not exceed 30 days unless the member establishes the reasons a longer postponement is necessary.

(3) Consultation Process

In conducting its evaluation of whether a member should be designated as a Restricted Firm and subject to a Restricted Deposit Requirement, the Department shall consider:

(A) information provided by the member during any meetings as part of the Consultation;

(B) relevant information or documents, if any, submitted by the member, in the manner and form prescribed by the Department, as shall be necessary or appropriate for the Department to review the computation of the Preliminary Criteria for Identification;

(C) a plan, if any, submitted by the member, in the manner and form prescribed by the Department, proposing in detail the specific conditions or restrictions that the member seeks to have the Department consider;

(D) such other information or documents as the Department may reasonably request in its discretion from the member related to the evaluation; and

(E) any other information the Department deems necessary or appropriate to evaluate the matter.

(e) Department Decision and Notice

(1) Department Decision

No later than 30 days from the Consultation, the Department shall render a Department Decision as follows:

(A) If the Department determines that the member has rebutted the presumption set forth in paragraph (d)(1)(A) of this Rule that it should be designated as a Restricted Firm, the Department's decision shall state that the firm shall not be designated as a Restricted Firm.

(B) If the Department determines that the member has failed to rebut the presumption set forth in paragraphs (d)(1)(A) and (d)(1)(B) of this Rule that it should be designated as a Restricted Firm that shall be subject to the maximum Restricted Deposit Requirement, the Department's decision shall designate the member as a Restricted Firm and require the member to: (i) promptly establish a Restricted Deposit Account and deposit in that account the maximum Restricted Deposit Requirement; and (ii) implement and maintain specified conditions or restrictions, as the Department deems necessary or appropriate, on the operations and activities of the member and its associated persons to address the concerns indicated by the Preliminary Criteria for Identification and protect investors and the public interest.

(C) If the Department determines that the member has failed to rebut the presumption in paragraph (d)(1)(A) of this Rule that it should be designated as a Restricted Firm but that it has rebutted the presumption in paragraph (d)(1)(B) of this Rule that it shall be subject to the maximum Restricted Deposit Requirement, the Department shall designate the member as a Restricted Firm and shall: (i) impose no Restricted Deposit Requirement on the member or require the member to promptly establish a Restricted Deposit Account and deposit in that account a Restricted Deposit Requirement in such dollar amount less than the maximum Restricted Deposit Requirement as the Department deems necessary or appropriate; and (ii) require the member to implement and maintain specified conditions or restrictions, as the Department deems necessary or appropriate, on the operations and activities of the member and its associated persons to address the concerns indicated by the Preliminary Criteria for Identification and protect investors and the public interest.

(2) Notice of Department Decision, No Stays

No later than 30 days following the Consultation, the Department shall issue a notice of the Department's decision pursuant to Rule 9561(a) that states the obligations to be imposed on the member, if any, under this Rule 4111 and the ability of the member under Rule 9561 to request a hearing with the Office of Hearing Officers. A timely request for a hearing shall not stay the effectiveness of the notice issued under Rule 9561(a), except that for a notice under Rule 9561(a) a member subject to a Restricted Deposit Requirement shall be required to deposit in a Restricted Deposit Account the lesser of 25 percent of its Restricted Deposit Requirement or 25 percent of its average excess net capital during the prior calendar year, until the Office of Hearing Officers or the NAC issues a written decision under Rule 9559; provided, however, that a member that has been re-designated as a Restricted Firm as set forth in paragraph (f)(2) of this Rule and is already subject to a previously imposed Restricted Deposit Requirement shall be required to keep in the Restricted Deposit Account the assets then on deposit therein until the Office of Hearing Officers or NAC issues a written decision under Rule 9559.

(f) Continuation or Termination of Restricted Firm Obligations

(1) Currently Designated Restricted Firms

A member or Former Member that is currently designated as a Restricted Firm subject to the requirements of this Rule shall not be permitted to withdraw all or any portion of its Restricted Deposit Requirement, or seek to terminate or modify any deposit requirement, conditions, or restrictions that have been imposed pursuant to this Rule, without the prior written consent of the Department. There shall be a presumption that the Department shall deny an application by a member or Former Member that is currently designated as a Restricted Firm to withdraw all or any portion of its Restricted Deposit Requirement. An application under this paragraph for a withdrawal from a Restricted Deposit Requirement shall comply with the content requirements in paragraph (f)(3)(A)(i) through (iv) of this Rule.

(2) Re-Designation as a Restricted Firm

Where a member has been designated as a Restricted Firm in one year and is determined to meet the Preliminary Criteria for Identification the following year in accordance with paragraph (b) of this Rule, the Department shall provide a written letter to the member stating that it shall be re-designated as a Restricted Firm, and that the obligations previously imposed on the member in accordance with this Rule shall remain effective and unchanged, unless either the member or the Department requests a Consultation in writing within seven days of the date of the letter, in which case the obligations previously imposed shall remain effective and unchanged unless and until the Department modifies or terminates them after the Consultation. If a Consultation is conducted, there shall be a presumption that the Restricted Deposit Requirement and conditions or restrictions, if any, previously imposed on the member shall remain effective and unchanged absent a showing by the party seeking changes that the previously imposed obligations are no longer necessary or appropriate for the protection of investors or in the public interest. If a Consultation is not timely requested, the member shall be subject to paragraph (f)(1) of this Rule. When FINRA re-designates a member as a Restricted Firm and the member is subject to a Restricted Deposit Requirement, the member shall promptly after such re-designation (or, in the case where a hearing is requested pursuant to Rule 9561, promptly after the Office of Hearing Officers or the NAC issues a written decision under Rule 9559) deposit additional cash or qualified securities in the member's Restricted Deposit Account to the extent necessary to cause the aggregate value of the cash and qualified securities in the member's Restricted Deposit Account to be not less than its re-designated Restricted Deposit Requirement.

(3) Previously Designated Restricted Firms

(A) A member or Former Member that is a Restricted Firm in one year, but does not meet the Preliminary Criteria for Identification or is not designated as a Restricted Firm the following year(s), shall no longer be subject to any deposit requirement, conditions, or restrictions previously imposed on it under this Rule; provided, however, the member or Former Member shall not be permitted to withdraw any portion of its Restricted Deposit Requirement without submitting an application and obtaining the prior written consent of the Department. Such application shall:

(i) be made in such form and manner as FINRA may prescribe;

(ii) be accompanied by a copy of a current account statement for the member or Former Member's Restricted Deposit Account;

(iii) include a certification by the member's or Former Member's chief executive officer (or equivalent officer) stating the member's or Former Member's Restricted Deposit Requirement; the value of the cash or qualified securities on deposit in the member's or Former Member's Restricted Deposit Account; the value of cash or qualified securities on deposit in the member's or Former Member's Restricted Deposit Account that the member or Former Member is seeking the Department's consent to withdraw; and

(iv) include evidence that there are no "Covered Pending Arbitration Claims," unpaid arbitration awards or unpaid settlements relating to arbitrations outstanding against the member, the member's associated persons or the Former Member, or if there are any "Covered Pending Arbitration Claims," unpaid arbitration awards or unpaid settlements relating to arbitrations outstanding, provide a detailed description of such.

(B) After such review and investigation as it considers necessary or appropriate, the Department shall determine whether to authorize a withdrawal, in part or whole, of cash or qualified securities from the member's or Former Member's Restricted Deposit Account. There shall be presumptions that the Department shall: (i) approve an application for withdrawal if the member, the member's associated persons, or the Former Member have no "Covered Pending Arbitration Claims," unpaid arbitration awards or unpaid settlements relating to arbitrations outstanding; and (ii) (a) deny an application for withdrawal if the member, the member's associated persons who are owners or control persons, or the Former Member have any "Covered Pending Arbitration Claims," unpaid arbitration awards or unpaid settlements relating to arbitrations outstanding, or if the member's associated persons have any "Covered Pending Arbitration Claims," unpaid arbitration awards or unpaid settlements relating to arbitrations outstanding that involved conduct or alleged conduct that occurred while associated with the member; but (b) approve an application by a Former Member for withdrawal if the Former Member commits in the manner specified by the Department to use the amount it seeks to withdraw from its Restricted Deposit to pay the Former Member's specified unpaid arbitration awards or unpaid settlements relating to arbitrations outstanding. Within 30 days from the date the application is received by the Department, the Department shall issue a notice of the Department's decision pursuant to Rule 9561(a).

(g) Books and Records

Each member shall maintain records evidencing the member's compliance with this Rule and any Restricted Deposit Requirement or conditions or restrictions imposed in accordance with this Rule, including without limitation, records relating to the calculation of the Preliminary Criteria for Identification, Consultation, the Restricted Deposit Account, conditions or restrictions imposed, and agreements with bank(s) or clearing firm(s), for a period of six years from the date the member is no longer subject to the requirements of this Rule. In addition, a firm that is subject to a Restricted Deposit Requirement shall provide to the Department, upon its request, records, agreements and account statements that demonstrate the firm's compliance with the Restricted Deposit Requirement.

(h) Notice of Failure to Comply

Pursuant to the procedure set forth in Rule 9561(b), FINRA may issue a suspension or cancellation notice to a member that is not in compliance with a Restricted Deposit Requirement or conditions or restrictions imposed by this Rule, stating that the failure to comply within seven days of service of the notice will result in a suspension or cancellation of membership.

(i) Definitions

For purposes of this Rule, the following terms shall have the following meanings:

(1) The term "Consultation" means one or more meetings or consultations between the Department and a member that meets the Preliminary Criteria for Identification.

(2) The term "Covered Pending Arbitration Claim," for purposes of this Rule 4111, means an investment-related, consumer initiated claim filed against the member or its associated persons in any arbitration forum that is unresolved; and whose claim amount (individually or, if there is more than one claim, in the aggregate) exceeds the member's excess net capital. For purposes of this definition, the claim amount includes claimed compensatory loss amounts only, not requests for pain and suffering, punitive damages or attorney's fees, and shall be the maximum amount for which the member or associated person, as applicable, is potentially liable regardless of whether the claim was brought against additional persons or the associated person reasonably expects to be indemnified, share liability or otherwise lawfully avoid being held responsible for all or part of such maximum amount.

(3) The term "Department" means FINRA's Department of Member Regulation.

(4) The term "Disclosure Event and Expelled Firm Association Categories" means the following categories of disclosure events and other information:

(A) "Registered Person Adjudicated Events" means any one of the following events that are reportable on the registered person's Uniform Registration Forms:

(i) a final investment-related, consumer-initiated customer arbitration award or civil judgment against the registered person in which the registered person was a named party or was a "subject of" the customer arbitration award or civil judgment;

(ii) a final investment-related, consumer-initiated customer arbitration settlement, civil litigation settlement or a settlement prior to a customer arbitration or civil litigation for a dollar amount at or above $15,000 in which the registered person was a named party or was a "subject of" the customer arbitration settlement, civil litigation settlement or a settlement prior to a customer arbitration or civil litigation;

(iii) a final investment-related civil judicial matter that resulted in a finding, sanction or order;

(iv) a final regulatory action that resulted in a finding, sanction or order, and was brought by the SEC or Commodity Futures Trading Commission (CFTC), other federal regulatory agency, a state regulatory agency, a foreign financial regulatory authority, or a self-regulatory organization; or

(v) a criminal matter in which the registered person was convicted of or pled guilty or nolo contendere (no contest) in a domestic, foreign, or military court to any felony or any reportable misdemeanor.

(B) "Registered Person Pending Events" means any one of the following events associated with the registered person that are reportable on the registered person's Uniform Registration Forms:

(i) a pending investment-related civil judicial matter;

(ii) a pending investigation by a regulatory authority;

(iii) a pending regulatory action that was brought by the SEC or CFTC, other federal regulatory agency, a state regulatory agency, a foreign financial regulatory authority, or a self-regulatory organization; or

(iv) a pending criminal charge associated with any felony or any reportable misdemeanor.

(C) "Registered Person Termination and Internal Review Events" means any one of the following events associated with the registered person at a previous member that are reportable on the registered person's Uniform Registration Forms:

(i) a termination in which the registered person voluntarily resigned, was discharged or was permitted to resign from a previous member after allegations; or

(ii) a pending or closed internal review by a previous member.

(D) "Member Firm Adjudicated Events" means any one of the following events that are reportable on the member's Uniform Registration Forms, or are based on customer arbitrations filed with FINRA's dispute resolution forum:

(i) a final investment-related, consumer-initiated customer arbitration award in which the member was a named party;

(ii) a final investment-related civil judicial matter that resulted in a finding, sanction or order;

(iii) a final regulatory action that resulted in a finding, sanction or order, and was brought by the SEC or CFTC, other federal regulatory agency, a state regulatory agency, a foreign financial regulatory authority, or a self-regulatory organization; or

(iv) a criminal matter in which the member was convicted of or pled guilty or nolo contendere (no contest) in a domestic, foreign, or military court to any felony or any reportable misdemeanor.

(E) "Member Firm Pending Events" means any one of the following events that are reportable on the member's Uniform Registration Forms:

(i) a pending investment-related civil judicial matter;

(ii) a pending regulatory action that was brought by the SEC or CFTC, other federal regulatory agency, a state regulatory agency, a foreign financial regulatory authority, or a self-regulatory organization; or

(iii) a pending criminal charge associated with any felony or any reportable misdemeanor.

(F) "Registered Persons Associated with Previously Expelled Firms" means any Registered Person In-Scope who was registered for at least one year with a previously expelled firm and whose registration with the previously expelled firm terminated during the Evaluation Period.

(5) The term "Evaluation Date" means the date, each calendar year, as of which the Department calculates the Preliminary Identification Metrics to determine if the member meets the Preliminary Criteria for Identification.

(6) The term "Evaluation Period" means the prior five years from the Evaluation Date, provided that for the Registered Person Pending Events and Member Firm Pending Events categories and pending internal reviews in the Registered Person Termination and Internal Review Events category, it would correspond to the Evaluation Date (and include all events that are pending as of the Evaluation Date).

(7) The term "Former Member" means an entity that has withdrawn or resigned its FINRA membership, or that has had its membership cancelled or revoked.

(8) The term "qualified security" has the meaning given it in SEA Rule 15c3-3(a)(6).

(9) The term "Preliminary Criteria for Identification" means meeting the following conditions:

(A) Two or more of the member's Preliminary Identification Metrics are equal to or more than the corresponding Preliminary Identification Metrics Thresholds, and at least one of these metrics is among the following metrics:

(i) Registered Person Adjudicated Event Metric;

(ii) Member Firm Adjudicated Event Metric; and

(iii) Expelled Firm Association Metric; and

(B) The member has two or more Registered Person and Member Firm Events during the Evaluation Period.

(10) The term "Preliminary Identification Metrics" means the following six metrics that are based on the number of disclosure events (defined above) per Registered Persons In-Scope or percent of Registered Persons In-Scope associated with previously expelled firms:

(A) "Registered Person Adjudicated Event Metric" would be computed as the sum of Registered Person Adjudicated Events that reached a resolution during the Evaluation Period, across all Registered Persons In-Scope and divided by the number of Registered Persons In-Scope.

(B) "Registered Person Pending Event Metric" would be computed as the sum of Registered Person Pending Events as of the Evaluation Date, across all Registered Persons In-Scope and divided by the number of Registered Persons In-Scope.

(C) "Registered Person Termination and Internal Review Event Metric" would be computed as the sum of Registered Person Termination and Internal Review Events that reached a resolution during the Evaluation Period and pending internal reviews by a previous member as of the Evaluation Date, across all Registered Persons In-Scope and divided by the number of Registered Persons In-Scope.

(D) "Member Firm Adjudicated Event Metric" would be computed as the sum of Member Firm Adjudicated Events that reached a resolution during the Evaluation Period, divided by the number of Registered Persons In-Scope.

(E) "Member Firm Pending Event Metric" would be computed as the sum of Member Firm Pending Events as of the Evaluation Date, divided by the number of Registered Persons In-Scope.

(F) "Expelled Firm Association Metric" would be computed as the sum of Registered Persons Associated with Previously Expelled Firms, divided by the number of Registered Persons In-Scope.

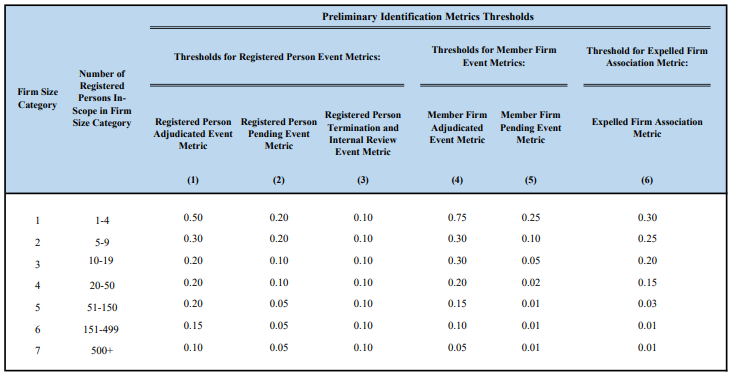

(11) The term "Preliminary Identification Metrics Thresholds" means the following thresholds corresponding to each of the six Preliminary Identification Metrics.

(12) The term "Registered Person and Member Firm Events" means the sum of the following categories of defined events during the Evaluation Period:

(A) Registered Person Adjudicated Events;

(B) Registered Person Pending Events;

(C) Registered Person Termination and Internal Review Events;

(D) Member Firm Adjudicated Events; and

(E) Member Firm Pending Events.

(13) The term "Registered Persons In-Scope" means all persons registered with the firm for one or more days within the one year prior to the Evaluation Date.

(14) The term "Restricted Deposit Account" means an account in the name of the member:

(A) at a bank (as defined in Section 3(a)(6) of the Exchange Act) or the member's clearing firm;

(B) subject to an agreement in which the bank or the member's clearing firm, as applicable, agrees:

(i) not to permit withdrawals (other than withdrawals of interest or the withdrawal of qualified securities or cash after and on the same day as the deposit of cash or qualified securities of equal value) from the Restricted Deposit Account without the prior written consent of FINRA;

(ii) to keep the account separate from any other accounts maintained by the member with the bank or clearing firm;

(iii) that the cash or securities on deposit in the account will at no time be used directly or indirectly as security for a loan to the member by the bank or clearing firm and will not be subject to any set-off, right, charge, security interest, lien, or claim of any kind in favor of the bank, clearing firm or any person claiming through the bank or clearing firm;

(iv) that if the member becomes a Former Member, the assets deposited in the Restricted Deposit Account to satisfy the Restricted Deposit Requirement shall be kept in the Restricted Deposit Account, and the bank or clearing firm will not permit withdrawals from the Restricted Deposit Account without the prior written consent of FINRA as set forth in paragraphs (f)(1) and (f)(3) of this Rule; and

(v) that FINRA is a third-party beneficiary to such agreement and that such agreement may not be amended without the prior written consent of FINRA; and

(C) not subject to any right, charge, security interest, lien or claim of any kind granted by the member.

(15) The term "Restricted Deposit Requirement" means one of the following amounts:

(A) the specific maximum Restricted Deposit Requirement for a member, determined by the Department taking into consideration the nature of the firm's operations and activities, revenues, commissions, assets, liabilities, expenses, net capital, the number of offices and registered persons, the nature of the disclosure events counted in the numeric thresholds, insurance coverage for customer arbitration awards or settlements, concerns raised during FINRA exams, and the amount of any of the firm's or its associated persons' Covered Pending Arbitration Claims, unpaid arbitration awards or unpaid settlements related to arbitrations. Based on a review of these factors, the Department would determine a maximum Restricted Deposit Requirement for the member that would be consistent with the objectives of this Rule, but would not significantly undermine the continued financial stability and operational capability of the firm as an ongoing enterprise over the next 12 months; or

(B) the amount, adjusted after the Consultation, determined by the Department; and

(C) with respect to a Former Member, the Restricted Deposit Requirement last calculated pursuant to paragraph (i)(15)(A) or (15)(B) of this Rule when the firm was a member.

(16) The term "Restricted Firm" means each member that is designated as such in accordance with paragraphs (e)(1)(B) and (e)(1)(C) of this Rule.

(17) The term "Uniform Registration Forms" means the Forms BD, U4, U5 and U6, as applicable.

• • • Supplementary Material: --------------

.01 Net Capital Treatment of the Deposits in the Restricted Deposit Account. Because of the restrictions on withdrawals from a Restricted Deposit Account, deposits in such an account cannot be readily converted into cash and therefore shall be deducted in determining the member's net capital under SEA Rule 15c3-1 and FINRA Rule 4110.

.02 Compliance with Rule 1017. Nothing in this Rule shall be construed as altering in any manner a member's obligations under Rule 1017.

.03 Examples of Conditions and Restrictions. For purposes of this Rule, the conditions or restrictions that the Department may impose include, but are not limited to, the following:

(a) limitations on business expansions, mergers, consolidations or changes in control;

(b) filing all advertising with FINRA's Department of Advertising Regulation;

(c) imposing requirements on establishing and supervising offices;

(d) requiring a compliance audit by a qualified, independent third party;

(e) limiting business lines or product types offered;

(f) limiting the opening of new customer accounts;

(g) limiting approvals of registered persons entering into borrowing or lending arrangements with their customers;

(h) requiring the member to impose specific conditions or limitations on, or to prohibit, registered persons' outside business activities of which the member has received notice pursuant to Rule 3270; and

(i) requiring the member to prohibit or, as part of its supervision of approved private securities transactions for compensation under Rule 3280 or otherwise, impose specific conditions on associated persons' participation in private securities transactions of which the member has received notice pursuant to Rule 3280.

| Amended by by SR-FINRA-2022-014 eff. May 26, 2022. Adopted by by SR-FINRA-2020-041 eff. Jan. 1, 2022. Selected Notice: 21-34. |